Skybookings Capital exists to solve one of the most common constraints faced by curators: access to working capital that is aligned with the realities of events.

Mzansi Neosoul Picnic 2025 & 2026, Supported by Skybookings Capital.

Events require upfront commitment — venues, suppliers, marketing, talent — long before the first patron arrives. Traditional funding options often fail

to match this reality, introducing debt structures that increase risk and reduce flexibility.

Skybookings Capital takes a different approach. We do not offer loans, we buy a block of tickets in your upcoming event at a preferential rate, which gives you immediate access to capital while we wait for those tickets to sell on our platform to recoup the funds.

This is not a loan, it is a partnership based on mutual trust.

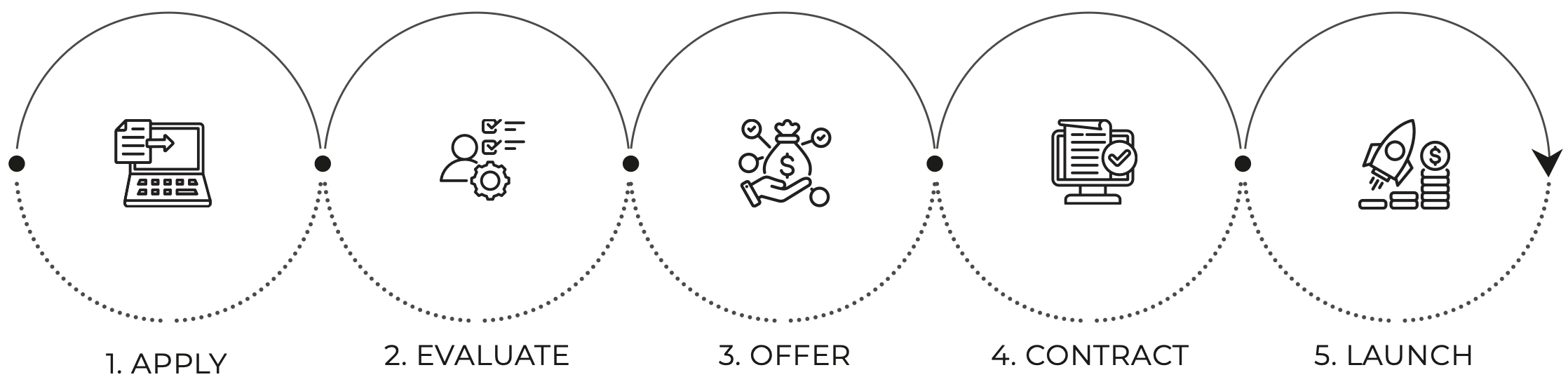

1. Applying: Provide details about your past three to five events and your next one.

2. Evaluation: We assess the event using clear criteria focusing on demand readiness and risk.

3. Offer to Purchase: If the event qualifies, we offer to purchase a portion of your ticket inventory, outlining pricing, timelines, and terms upfront.

4. Contracting: Provide details about your past three to five events and your next one.

5. Launching with Capital: We assess the event using clear criteria focusing on demand readiness and risk.

This funding model is not a loan. By accessing capital upfront through ticket sales, curators fund suppliers, marketing, and production without taking on unnecessary debt or sacrificing creative control.

This is funding with clear terms, a predictable structure based on future ticket sales and flexibility to deliver your next event.

No, Skybookings Capital does not lend money. We purchase a portion of your event tickets upfront and resell them on skybookings.com. You receive cash early by selling tickets in advance, not by taking on debt.

We buy a clearly defined block of tickets for a specific event with the condition that all the tickets for the event will be sold at skybookings.com. The quantity, price per ticket, and payout details are set out in an Offer to Purchase that both parties agree to upfront.

Once we have recovered the capital outlay plus the negotiated margin, normal payouts and fees resume.

If the event moves to a new date, tickets remain valid, the purchased ticket block carries over, and no penalties apply. This gives events room to recover without resetting the agreement

If your event does not sell sufficient tickets to cover the capital, you will not owe Skybookings Capital because this is not a loan, it is a shared risk.

The curator remains liable for delivering on their promise to patrons and Skybookings Capital. Therefore in the event of cancellation, the curator is liable to refund patrons and Skybookings Capital. The terms of the cancellation are clearly stipulated in the agreement.

063 902 9467 (WhatsApp Only)

support@skybookings.com

155 West Street, Sandton CBD, Johannesburg, South Africa.